Every business needs money to start up, grow, and handle... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Subjects

Classic Dramatic Literature

Modern Lyric Poetry

Influential English-Language Authors

Classic and Contemporary Novels

Literary Character Analysis

Romantic and Love Poetry

Reading Analysis and Interpretation

Evidence Analysis and Integration

Author's Stylistic Elements

Figurative Language and Rhetoric

Show all topics

Human Organ Systems

Cellular Organization and Development

Biomolecular Structure and Organization

Enzyme Structure and Regulation

Cellular Organization Types

Biological Homeostatic Processes

Cellular Membrane Structure

Autotrophic Energy Processes

Environmental Sustainability and Impact

Neural Communication Systems

Show all topics

Social Sciences Research & Practice

Social Structure and Mobility

Classic Social Influence Experiments

Social Systems Theories

Family and Relationship Dynamics

Memory Systems and Processes

Neural Bases of Behavior

Social Influence and Attraction

Psychotherapeutic Approaches

Human Agency and Responsibility

Show all topics

Chemical Sciences and Applications

Chemical Bond Types and Properties

Organic Functional Groups

Atomic Structure and Composition

Chromatographic Separation Principles

Chemical Compound Classifications

Electrochemical Cell Systems

Periodic Table Organization

Chemical Reaction Kinetics

Chemical Equation Conservation

Show all topics

Nazi Germany and Holocaust 1933-1945

World Wars and Peace Treaties

European Monarchs and Statesmen

Cold War Global Tensions

Medieval Institutions and Systems

European Renaissance and Enlightenment

Modern Global Environmental-Health Challenges

Modern Military Conflicts

Medieval Migration and Invasions

World Wars Era and Impact

Show all topics

389

•

11 Feb 2026

•

Emma F

@emmaxfaulkner

Every business needs money to start up, grow, and handle... Show more

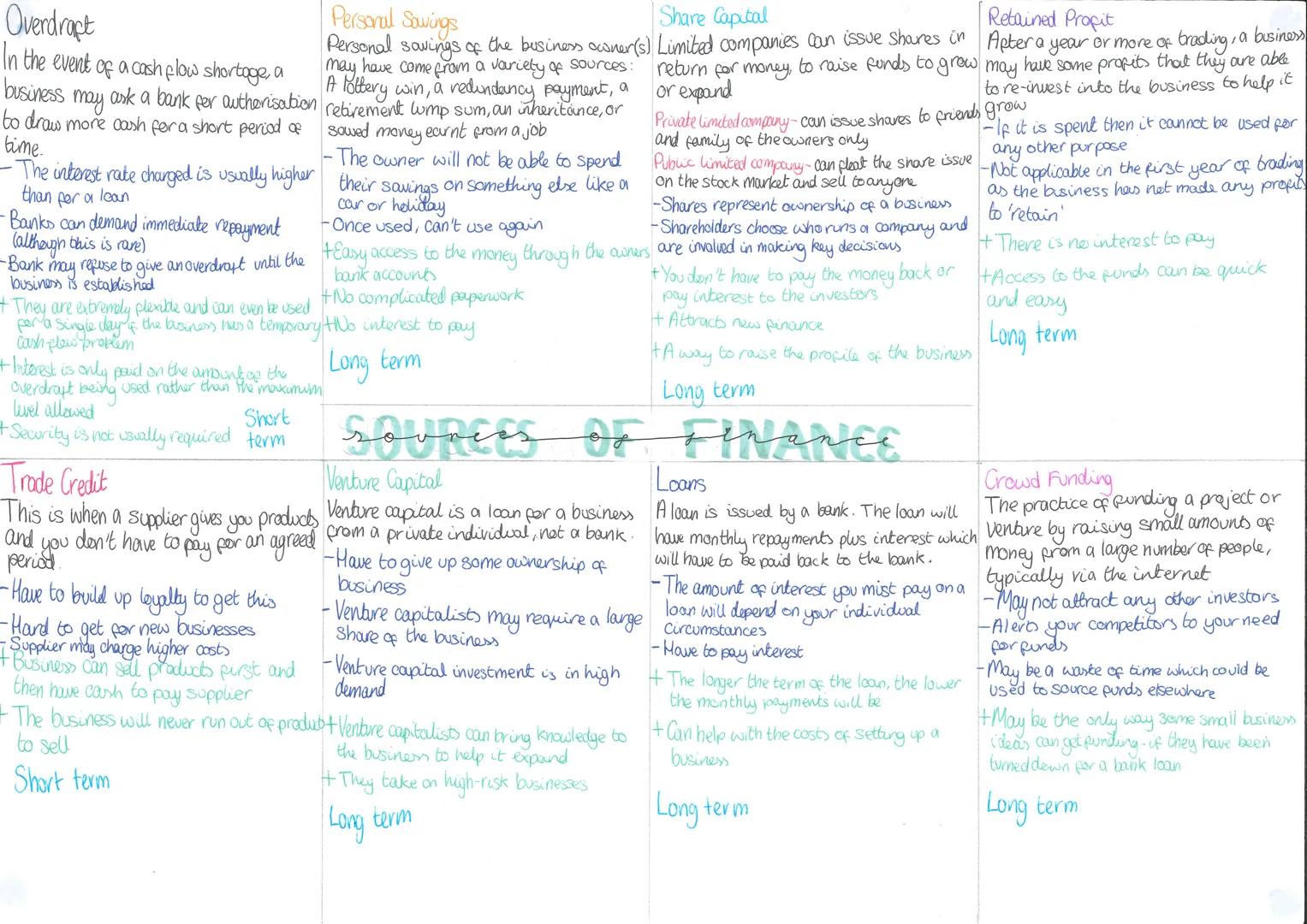

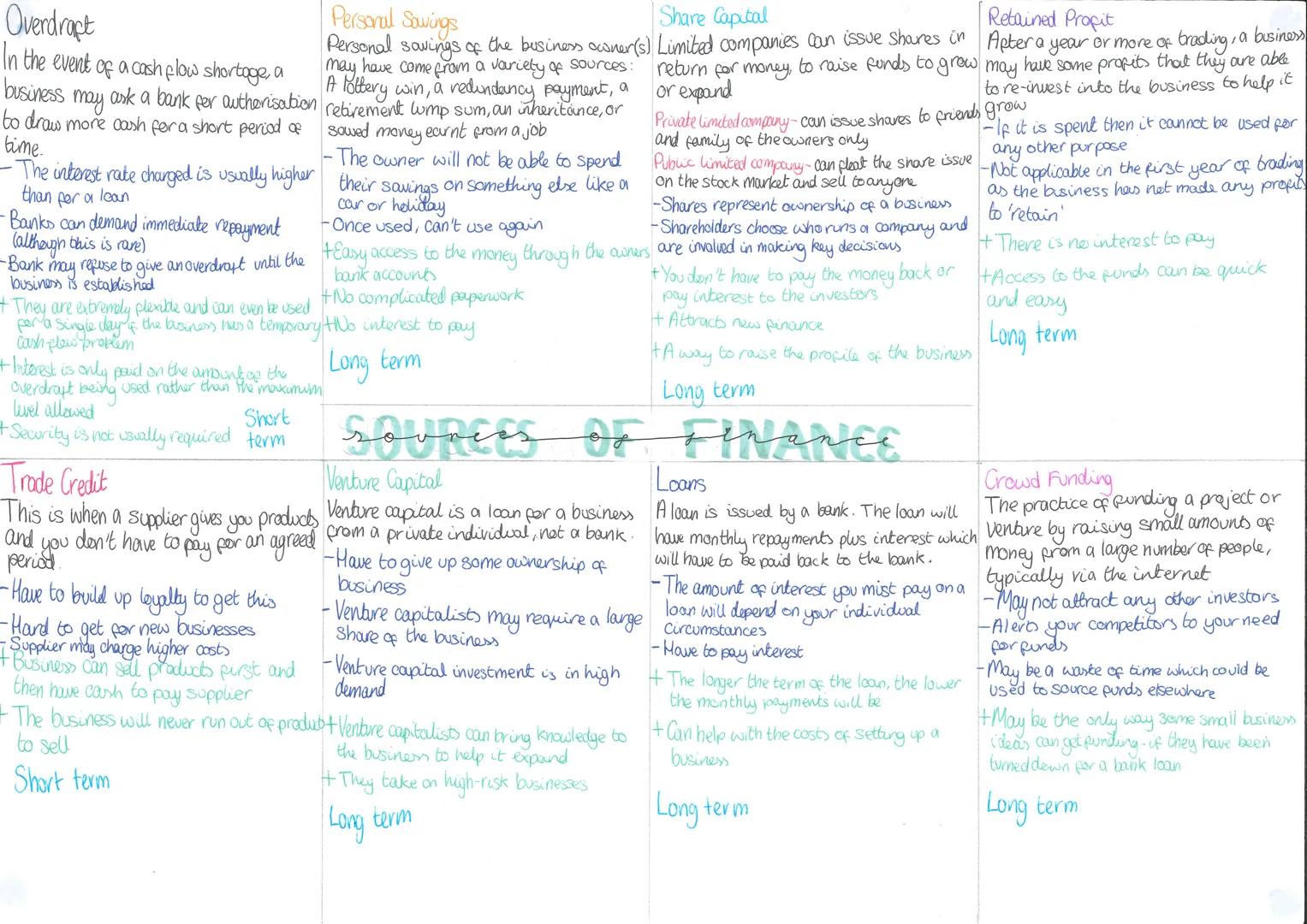

Whether you're launching the next big thing or just keeping the lights on, businesses have loads of different ways to get their hands on cash. Each option comes with its own perks and pitfalls, so let's break down what's actually available.

Short-term finance sorts out immediate cash problems - think overdrafts and trade credit. These are your quick fixes when money's tight for a few weeks or months. Long-term finance is the heavy-duty stuff like loans, share capital, and venture capital that fuel major growth and expansion plans.

Quick Tip: Match your financing choice to your actual needs - don't take out a 5-year loan just to cover next month's bills!

The key is knowing when to use each type. Personal savings might get you started, but you'll probably need something bigger like share capital or a loan to really scale up your business. Smart entrepreneurs often mix different sources rather than putting all their eggs in one basket.

Overdrafts let you spend money you don't actually have yet - perfect for covering short-term cash flow gaps. Your bank sets a limit, you only pay interest on what you use, and it's incredibly flexible. The downside? Higher interest rates than loans, and banks can demand immediate repayment if they get nervous.

Personal savings are often where it all begins - your lottery win, inheritance, or money you've squirreled away from your Saturday job. No interest payments and total control, but once it's gone, it's gone, and you can't exactly blow your life savings on that holiday to Ibiza anymore.

Our AI Companion is a student-focused AI tool that offers more than just answers. Built on millions of Knowunity resources, it provides relevant information, personalised study plans, quizzes, and content directly in the chat, adapting to your individual learning journey.

You can download the app from Google Play Store and Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user

Emma F

@emmaxfaulkner

Every business needs money to start up, grow, and handle day-to-day operations, but where does this cash actually come from? Understanding the different sources of finance is crucial for anyone thinking about starting their own business or working in the... Show more

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Whether you're launching the next big thing or just keeping the lights on, businesses have loads of different ways to get their hands on cash. Each option comes with its own perks and pitfalls, so let's break down what's actually available.

Short-term finance sorts out immediate cash problems - think overdrafts and trade credit. These are your quick fixes when money's tight for a few weeks or months. Long-term finance is the heavy-duty stuff like loans, share capital, and venture capital that fuel major growth and expansion plans.

Quick Tip: Match your financing choice to your actual needs - don't take out a 5-year loan just to cover next month's bills!

The key is knowing when to use each type. Personal savings might get you started, but you'll probably need something bigger like share capital or a loan to really scale up your business. Smart entrepreneurs often mix different sources rather than putting all their eggs in one basket.

Overdrafts let you spend money you don't actually have yet - perfect for covering short-term cash flow gaps. Your bank sets a limit, you only pay interest on what you use, and it's incredibly flexible. The downside? Higher interest rates than loans, and banks can demand immediate repayment if they get nervous.

Personal savings are often where it all begins - your lottery win, inheritance, or money you've squirreled away from your Saturday job. No interest payments and total control, but once it's gone, it's gone, and you can't exactly blow your life savings on that holiday to Ibiza anymore.

Our AI Companion is a student-focused AI tool that offers more than just answers. Built on millions of Knowunity resources, it provides relevant information, personalised study plans, quizzes, and content directly in the chat, adapting to your individual learning journey.

You can download the app from Google Play Store and Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

2

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Mock Exam ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user