Planning a business properly is crucial for success, and it... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Subjects

Classic Dramatic Literature

Modern Lyric Poetry

Influential English-Language Authors

Classic and Contemporary Novels

Literary Character Analysis

Romantic and Love Poetry

Reading Analysis and Interpretation

Evidence Analysis and Integration

Author's Stylistic Elements

Figurative Language and Rhetoric

Show all topics

Human Organ Systems

Cellular Organization and Development

Biomolecular Structure and Organization

Enzyme Structure and Regulation

Cellular Organization Types

Biological Homeostatic Processes

Cellular Membrane Structure

Autotrophic Energy Processes

Environmental Sustainability and Impact

Neural Communication Systems

Show all topics

Social Sciences Research & Practice

Social Structure and Mobility

Classic Social Influence Experiments

Social Systems Theories

Family and Relationship Dynamics

Memory Systems and Processes

Neural Bases of Behavior

Social Influence and Attraction

Psychotherapeutic Approaches

Human Agency and Responsibility

Show all topics

Chemical Sciences and Applications

Chemical Bond Types and Properties

Organic Functional Groups

Atomic Structure and Composition

Chromatographic Separation Principles

Chemical Compound Classifications

Electrochemical Cell Systems

Periodic Table Organization

Chemical Reaction Kinetics

Chemical Equation Conservation

Show all topics

Nazi Germany and Holocaust 1933-1945

World Wars and Peace Treaties

European Monarchs and Statesmen

Cold War Global Tensions

Medieval Institutions and Systems

European Renaissance and Enlightenment

Modern Global Environmental-Health Challenges

Modern Military Conflicts

Medieval Migration and Invasions

World Wars Era and Impact

Show all topics

94

•

3 Feb 2026

•

Nam

@nam_uxtoo

Planning a business properly is crucial for success, and it... Show more

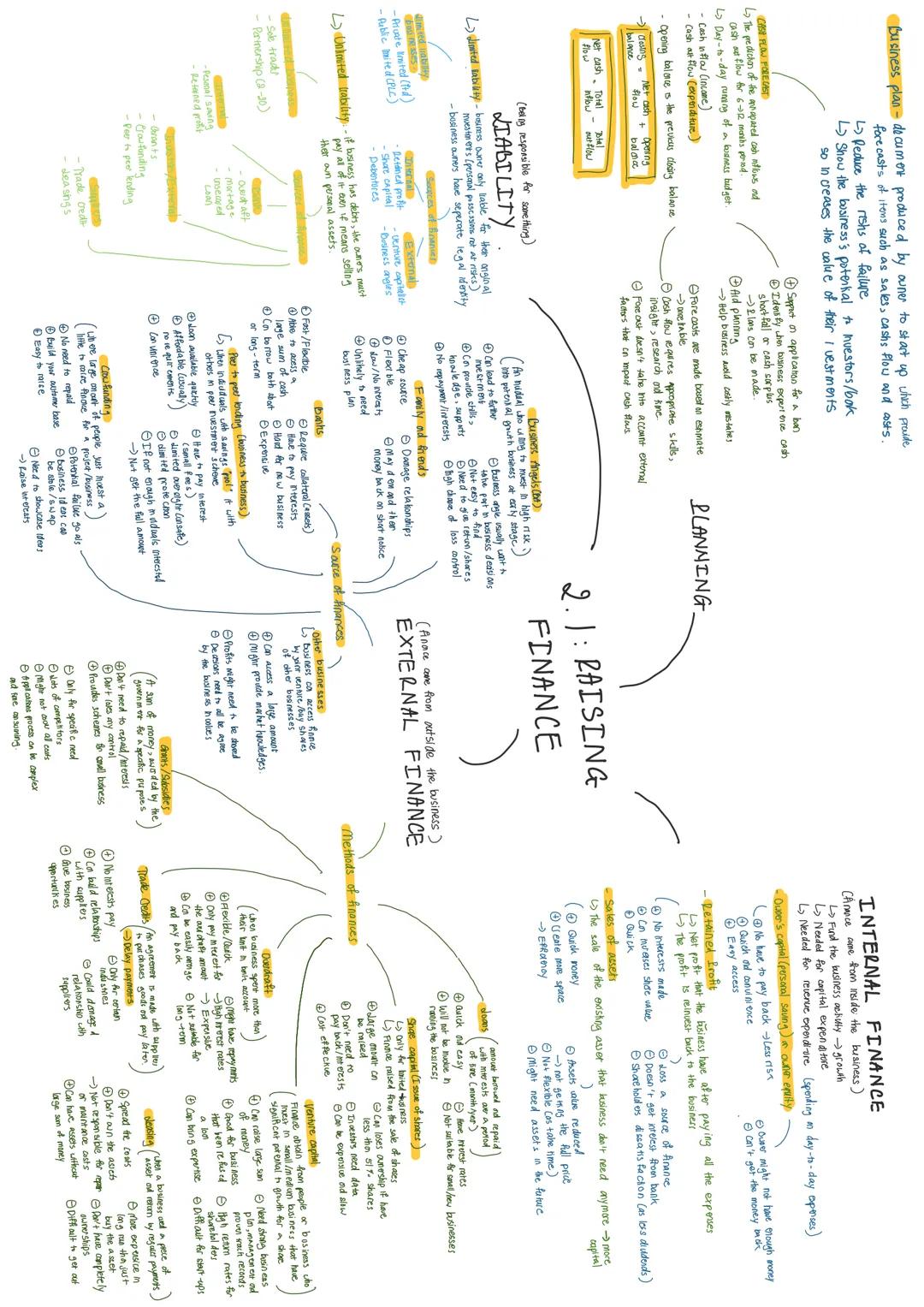

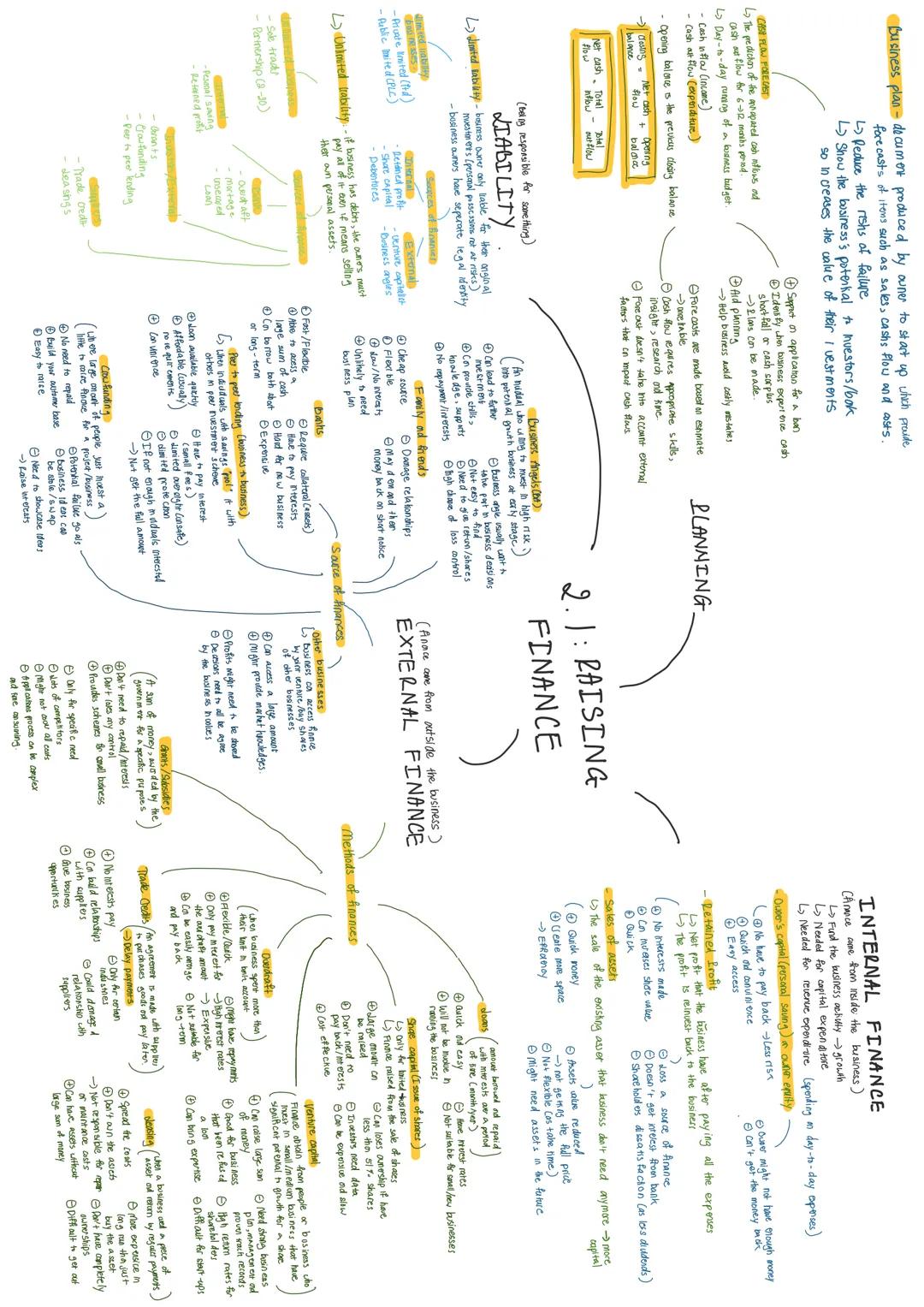

Every successful business starts with a business plan - think of it as your roadmap that shows potential investors and banks why your idea will actually make money. This document includes crucial forecasts for sales, costs, and most importantly, cash flow.

Cash flow forecasts are your crystal ball for predicting money coming in and going out over 6-12 months. The formula is simple: Opening Balance + Cash In - Cash Out = Closing Balance. Your closing balance becomes next month's opening balance, creating a continuous cycle that helps you spot potential money problems before they hit.

These forecasts aren't just paperwork - they're essential for day-to-day budget management and preventing the nightmare scenario where you can't pay your bills. However, remember that forecasts are based on estimates and require solid research skills to be accurate.

Key insight: Even the best cash flow forecasts can't predict external shocks like economic downturns or sudden market changes, so always build in some flexibility.

Limited liability is a game-changer for business owners. With Ltd (private limited) or PLC (public limited company) structures, owners are only responsible for their original investment if the business fails. Your personal possessions stay safe because the business has separate legal identity.

Unlimited liability is the scary alternative - if your business can't pay its debts, you're personally on the hook. This means potentially losing your house, car, or savings to cover business debts. Sole traders and partnerships (unless specially structured) face this risk.

The trade-off is simple: limited liability offers protection but comes with more regulations and paperwork. Unlimited liability gives you complete control but puts everything you own at risk.

Our AI Companion is a student-focused AI tool that offers more than just answers. Built on millions of Knowunity resources, it provides relevant information, personalised study plans, quizzes, and content directly in the chat, adapting to your individual learning journey.

You can download the app from Google Play Store and Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user

Nam

@nam_uxtoo

Planning a business properly is crucial for success, and it all starts with understanding how to create solid forecasts and secure the right funding. Whether you're preparing for exams or genuinely interested in entrepreneurship, mastering these financial fundamentals will give... Show more

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Every successful business starts with a business plan - think of it as your roadmap that shows potential investors and banks why your idea will actually make money. This document includes crucial forecasts for sales, costs, and most importantly, cash flow.

Cash flow forecasts are your crystal ball for predicting money coming in and going out over 6-12 months. The formula is simple: Opening Balance + Cash In - Cash Out = Closing Balance. Your closing balance becomes next month's opening balance, creating a continuous cycle that helps you spot potential money problems before they hit.

These forecasts aren't just paperwork - they're essential for day-to-day budget management and preventing the nightmare scenario where you can't pay your bills. However, remember that forecasts are based on estimates and require solid research skills to be accurate.

Key insight: Even the best cash flow forecasts can't predict external shocks like economic downturns or sudden market changes, so always build in some flexibility.

Limited liability is a game-changer for business owners. With Ltd (private limited) or PLC (public limited company) structures, owners are only responsible for their original investment if the business fails. Your personal possessions stay safe because the business has separate legal identity.

Unlimited liability is the scary alternative - if your business can't pay its debts, you're personally on the hook. This means potentially losing your house, car, or savings to cover business debts. Sole traders and partnerships (unless specially structured) face this risk.

The trade-off is simple: limited liability offers protection but comes with more regulations and paperwork. Unlimited liability gives you complete control but puts everything you own at risk.

Our AI Companion is a student-focused AI tool that offers more than just answers. Built on millions of Knowunity resources, it provides relevant information, personalised study plans, quizzes, and content directly in the chat, adapting to your individual learning journey.

You can download the app from Google Play Store and Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

3

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Mock Exam ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

Best app on earth! no words because it’s too good

Thomas R

iOS user

Just amazing. Let's me revise 10x better, this app is a quick 10/10. I highly recommend it to anyone. I can watch and search for notes. I can save them in the subject folder. I can revise it any time when I come back. If you haven't tried this app, you're really missing out.

Basil

Android user

This app has made me feel so much more confident in my exam prep, not only through boosting my own self confidence through the features that allow you to connect with others and feel less alone, but also through the way the app itself is centred around making you feel better. It is easy to navigate, fun to use, and helpful to anyone struggling in absolutely any way.

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

very reliable app to help and grow your ideas of Maths, English and other related topics in your works. please use this app if your struggling in areas, this app is key for that. wish I'd of done a review before. and it's also free so don't worry about that.

Rohan U

Android user

I know a lot of apps use fake accounts to boost their reviews but this app deserves it all. Originally I was getting 4 in my English exams and this time I got a grade 7. I didn’t even know about this app three days until the exam and it has helped A LOT. Please actually trust me and use it as I’m sure you too will see developments.

Xander S

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This apps acc the goat. I find revision so boring but this app makes it so easy to organize it all and then you can ask the freeeee ai to test yourself so good and you can easily upload your own stuff. highly recommend as someone taking mocks now

Paul T

iOS user